Options traders can sell short combos of options with different directional biases and strike prices. If they think that the price of an underlying asset will not change significantly in the near future. Short Strangle Strategy is a type of option trading. It bets on a small move in either direction for an underlying stock over a specific time period.

In a directionless market, this is an options trading strategy that combines short puts and short calls to create positions that profit from option premium time decay. The lack of a defined price move in either direction is where the money is made.

Short strangle strategy to profit from the loss of long option premium on both sides of the play if the stock price does not move significantly up or down before the expiration of the options.

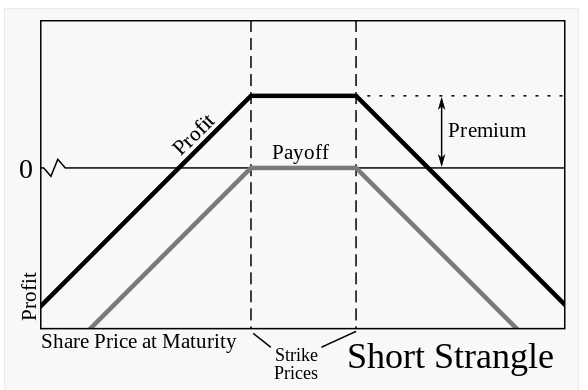

Short call options with a greater price and short put options with a lower strike price at the same expiration and on the same stock make up a short strangle. If the stock price does not move past the strangle’s strike prices, the position is profitable. Out-of-the-money strikes may pr in both the short call and short put options. A short strangle attempts to sell the extrinsic value of two options while ensuring that neither side has more intrinsic value than the premium received from both options by expiration. These strategies have higher costs and risks than standard one-sided option plays.

Short Strangle Strategy

Short Strangle Strategy can be high-risk plays during big price moves because one side of the options will usually go up in value while the other goes down.

When one side of an option play becomes worthless, the other side is usually worth more.

Short strangles can be profitable if the market remains tightly range-bound within both option strike prices.

Short option positions are less stressful to hold. When a hedge is in place in case one of the options moves against you. It does not include hedges, so these plays can be risky during big market moves.

The big risks are transfer from the option buyer to the short strangle seller of calls and puts.

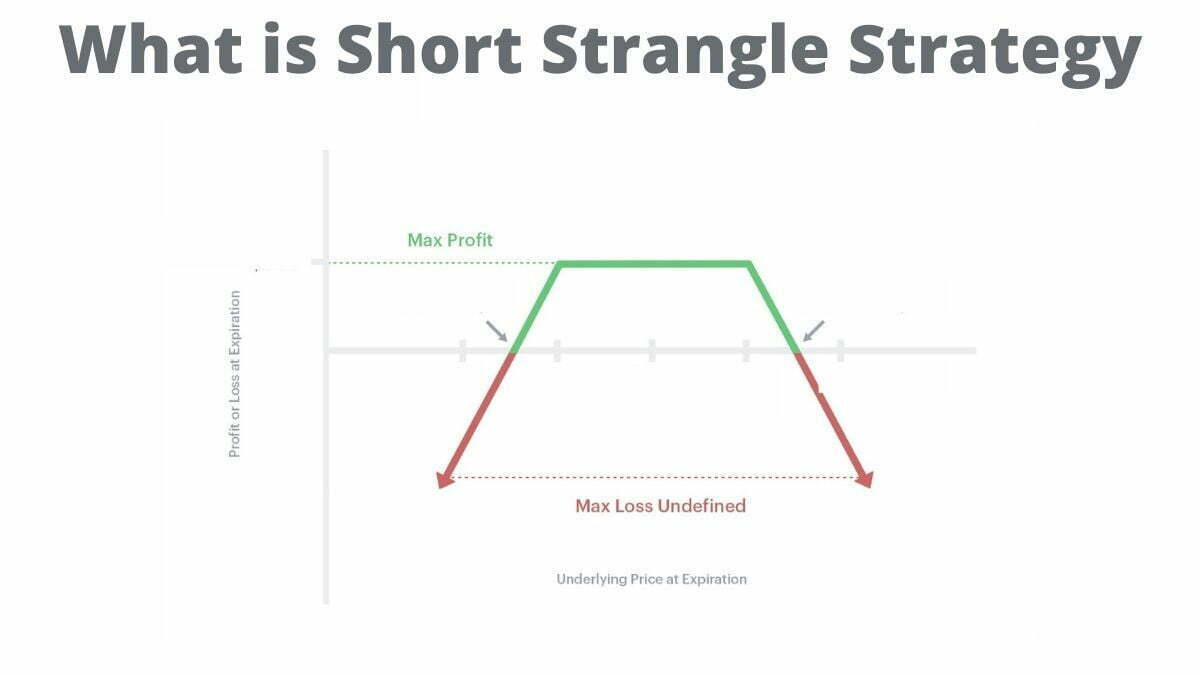

Short strangles lose when prices move a lot, but win when they don’t move at all. They are not asymmetrical bets in terms of construction. They can expose the seller to more risk than the option premium compensates. If one of the options is in the money, the maximum loss is unlimited. It’s critical to have a stop loss in risk based on a delta level below which the option play is no longer worthwhile.

If one side of the short options trades against you, you’ll end up on the long option trader’s side, and your losses will be their gains.

We can use Short strangles in any time frame.

The losing side of the option play has a growing delta, while the winning side has a shrinking delta with short strangles.

Short strangles is helpful to bet against big reversals, volatility, and trends.

What is the risk?

As long option traders wait for the move to occur. Time is on the side of the short strangle play. The theta value is being lost.

Options carry a higher liquidity risk than stocks, so only trade options with narrow bid/ask spreads. Buying the ask and selling the bid costs money to get in and out of these trades. For maximum liquidity, focus on front-month and close-to-the-money options.

If implied volatility falls and is priced out, the premium value of short strangle options can fall.

When a side of a short strangle hits the money, it becomes a directional bet with a high delta risk, and you must exit to limit your losses.

Options commissions are generally higher than stock commissions. Be aware of how much it costs with various numbers of contracts and how that will affect your profit and loss statement.

The short option strangle is a directionally neutral. It bet against a strong move or trend within a specific time frame.