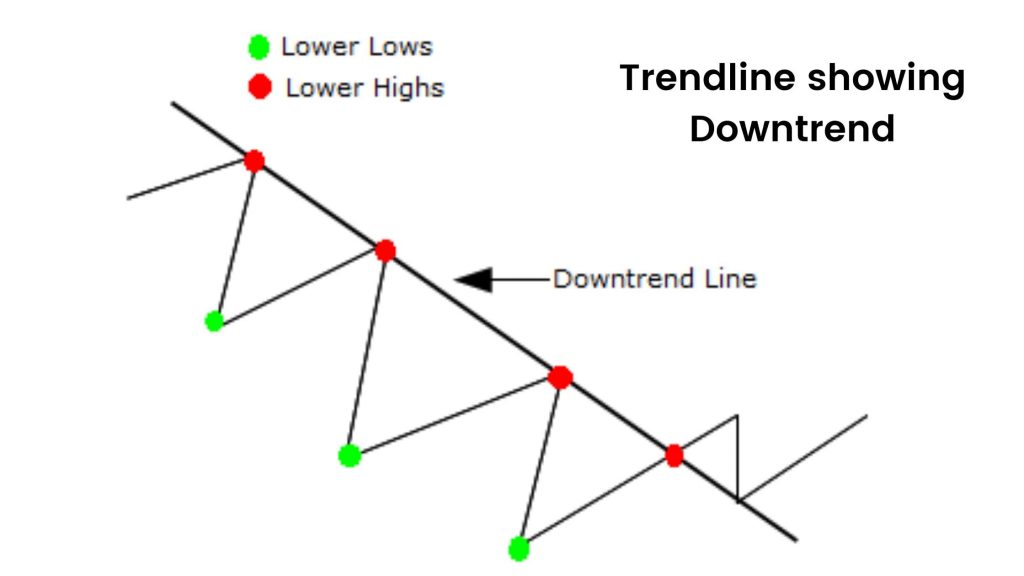

A downtrend is a price move that results in lower highs and lower lows over the specified time period. When a chart transitions from an accumulation or range trading phase to a stage distribution phase, a downtrend occurs. A distribution cycle can occur as a result of short-sellers initiating bearish positions and long holders exiting by selling on the way down and into rallies back to higher prices.

How to Identify Downtrend

When price resistance is reached on the chart and there are no buyers at those prices, a downtrend may begin. When there is more supply at lower prices than demand at higher prices, downtrends occur. Prices decrease as a result of selling pressure, as customers are hesitant to purchase until the price decreases. Each uptick in a downtrend is an indication for sellers to profit from temporarily higher prices.

Moving averages that remain on one side of a downward price move can be helpful to identify downtrends as well. During downtrends, price action typically remains below the moving average of the period frame in which this trend is occurring.

A price break above that timeframe’s moving average may signal the end of a downtrend.

A downward trend is a natural component of all charts and markets, as it is a component of the normal accumulation, range trading, volatility, and distribution cycles. The end of a downtrend may create additional opportunities for purchasing deeply oversold dips.

Downtrends end when the supply of lower-priced prices is exhausted. The buyers rush in to seize what they perceive to be an opportunity, constantly bidding up prices.

Follow us on Instagram